Promoters are selling, but ‘we’ don’t want you to buy

Indian promoters are making hay while the sun shines. 2024 will end up being the best year for IPOs. Let’s begin with our take on IPOs : we don’t like them 😊.

We love them as a process, since it is such an integral part of capital markets and therefore extremely critical for vibrancy in the economy. However, from the time the big daddies of the private markets ( VCs and PEs- venture Capital Funds and Private Equity Funds respectively) have arrived on the scene, IPOs have become tools to provide them exit. Don’t get me wrong, there is absolutely nothing wrong in that process and early risk investors need exits and returns for them to keep doing this (providing capital to entrepreneurs).

However, I as an investor wouldn’t want to provide them that exit. Why? IPOs are launched :

- during higher valuations

- when there is good news all around, for the economy, markets and the company

- Promoters feel they won’t get a better price to sell

Hence, a spike in IPOs is generally a sign of over-valuation. Let’s look at the year wise data for money raised through IPOs :

| Year | No. of IPOs | Amount Raised (Rs Cr) |

| 2017 | 38 | 75,279 |

| 2018 | 25 | 31,731 |

| 2019 | 16 | 12,687 |

| 2020 | 16 | 26,628 |

| 2021 | 63 | 1,19,882 |

| 2022 | 40 | 59,939 |

| 2023 | 58 | 49,437 |

| 2024* | 64 | 92,647 |

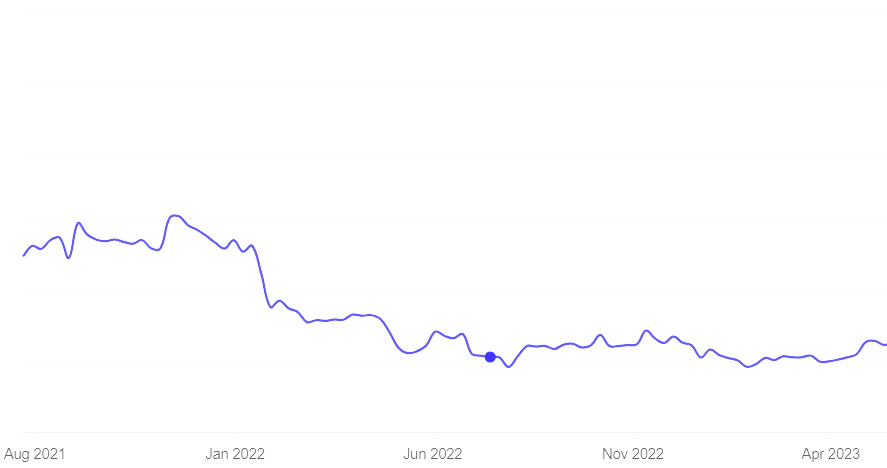

Not so surprisingly, we had written about it in 2021 as well, when Zomato had come up with it’s IPO. Hungry? Don’t Zomato just yet

While it had a fantastic listing, but if one had the patience, it could have been bought much cheaper

Non-work updates

On a personal level, the second half of the year is also my favourite time of the year. Apart from other reasons, most of the runs are organized in India from September to February. Last Sunday of August is ‘reserved’ for the Hyderabad Marathon, which is now an annual ritual. I am a proud Hyderabadi and a big shout out to the most amazing running event managers in the country – The Hyderabad Runners (20k runners participated). It’s a tough run, with humidity and elevation, playing their part.

I also ran a half marathon at the Vedanta Zinc City Half Marathon, organized in the beautiful lake city of Udaipur. I was joined by my MBA batchmates (one of them is from Udaipur).

BuckSpeak ‘growth’ – Chaar sau paar 😊

We are also looking to expand our team (we now manage more than 400 Cr of assets) and are extremely bullish on the wealth creation opportunity in this country through financial assets. Interested candidates can reach us at srivatsa@buckspeak.com. We are hiring for the Client Success and Client Relations roles. More details can be seen on our Linkedin page

BuckSpeak milestone achievement

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned