“plus ça change, plus c’est la même chose”

In 1849, French writer Jean-Baptiste Alphonse Karr wrote “plus ça change, plus c’est la même chose “ – the more things change, the more they stay the same…

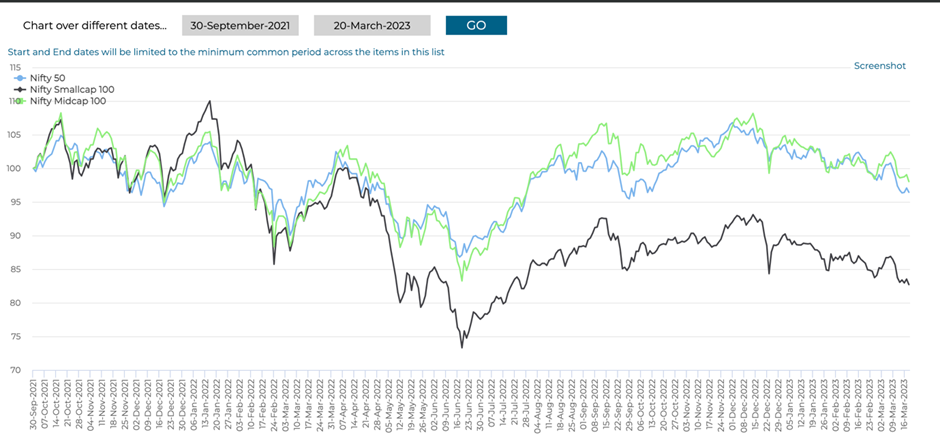

Last 18 months in equity markets :

While Small Cap index has corrected 17-18 % in absolute, the large and mid cap index have remained range bound and ended up at similar absolute level

Index levels hide more than they reveal

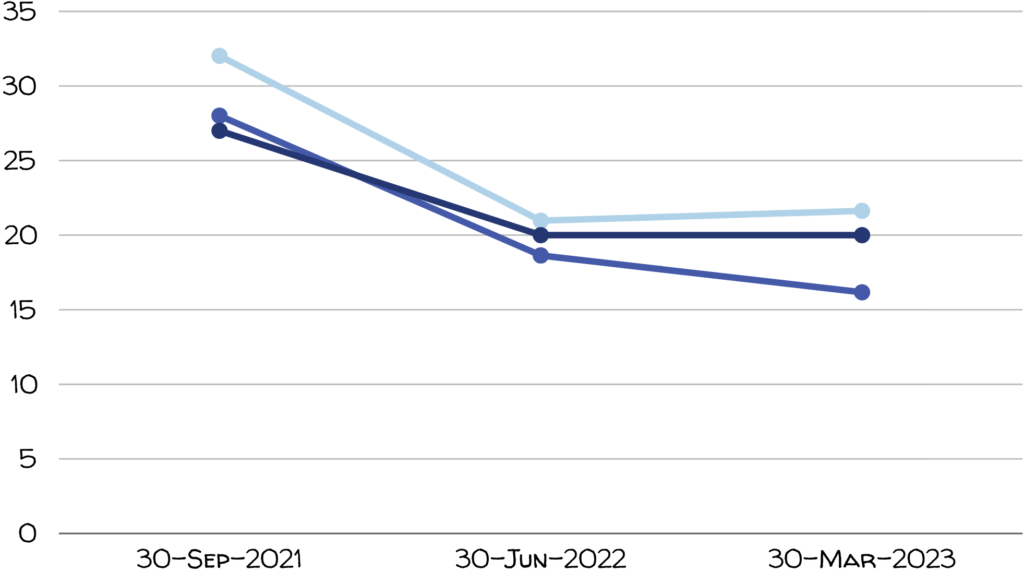

However, companies have had a robust last 18 months, posting strong profit. This has translated into market valuations correcting meaningfully.

Price to Earnings multiple, which is one of the key measures of valuation ( disclaimer : not the only one though) has come off from their highs :

Portfolio Action

June 2022 is when we had last invested lumpsum into Indian equities. The current levels is similar and we would be recommending investments into equity, either through fresh allocation or switch from debt. We would continue to set up regular transfers from debt to equity, over the next 12 months

Path ahead

The near term does look uncertain (on second thought, when has it been any different?). However, what we do know from past data, is that, 5-6 year investments into equity at these valuations, have delivered meaningful returns. At the huge risk of repeating ourselves, we would say, stay focused and invest for long term.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned