Boring Investments ? They are the best

Getting Bored of your Investments? You are on the right track

To quote Jason Zweig (Wall Street Journal columnist and one of my favourite writers on personal finance and investing) :

Scientifically speaking, boredom is a mildly unpleasant state of mind usually triggered by a monotonous environment. He further adds ‘There’s another possible danger. “Boredom might be catching,” says Robert R. Provine, a psychology professor at the University of Maryland, Baltimore County.

Investing as a conversation tool

To think about it; in a social context ; what’s more appealing ? Coming across as an Intelligent Investor, who is constantly unearthing exciting opportunities or an Investor who has outsourced her investing to Advisors, fund managers and the economy ? It’s a no-brainer. One big reason is that the second approach is boring, we hardly get any kick out of it, when it works.

Even as someone from the eco-system, I am often amazed on the space investment occupies in everyday conversation. It should gladden my heart, but it does not. In any case boring investments, that I am the torch-bearer for, gets very little mind space 😊

Current Times

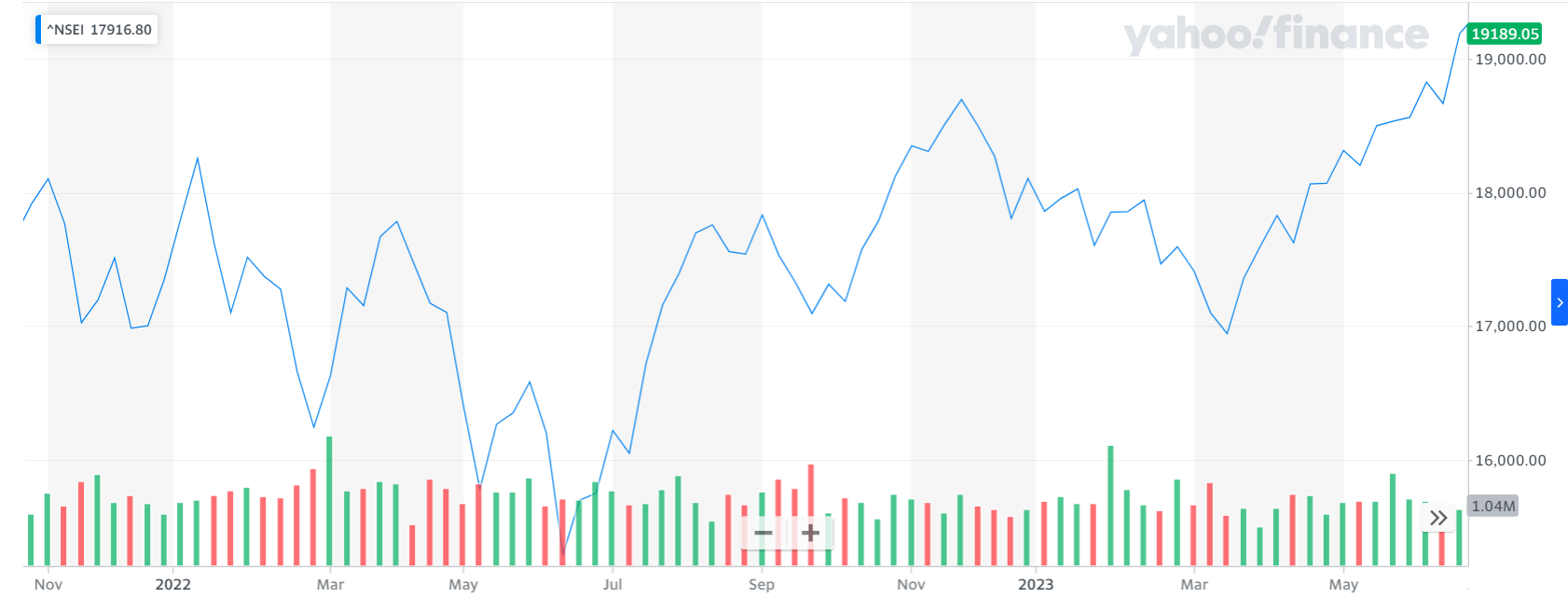

Why am I talking about it today ? Since Oct 2021, equity markets have been range-bound and in the 20 months( this is being written in June 2023), it is gone up 2-3 % ( image of Nifty).

It has been what I call ‘a boring period’ in the world of equity investing. Our clients know how much we love such periods. ‘Luckily’ for us, while the current levels are pretty similar to that seen in Oct 2021, the interim journey has been a V/ U Shaped one. Those are the best ones. We have been deploying through SIP/ STP and have been able to buy more units on the way down and reaped the benefits on the way up. Let’s look at the SIP/ STP returns for investments between Oct 2021 to June 2023 :

| Category of Funds | Approx. XIRR ( in % p.a. ) |

| Large Caps | 10-11 % |

| Diversified Funds | 11-12 % |

| Mid Caps | 12-14 % |

| Small Caps | 12-20 % |

And markets ? They have been ‘boring’

We might still be in a dull equity market. May be equity markets don’t go anywhere in the next 1-2 years. As illustrated above, it won’t be such a bad thing for our investments.

George Soros; one of the most well-known fund managers has this to say “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.