Our 2024 Year end note :-)

Wishing you and your entire family, a very Happy New Year. May 2025, bring in the best of health & happiness for you and your loved ones. As for prosperity, we at BuckSpeak will continue to be responsible for (at least some of) it :-).

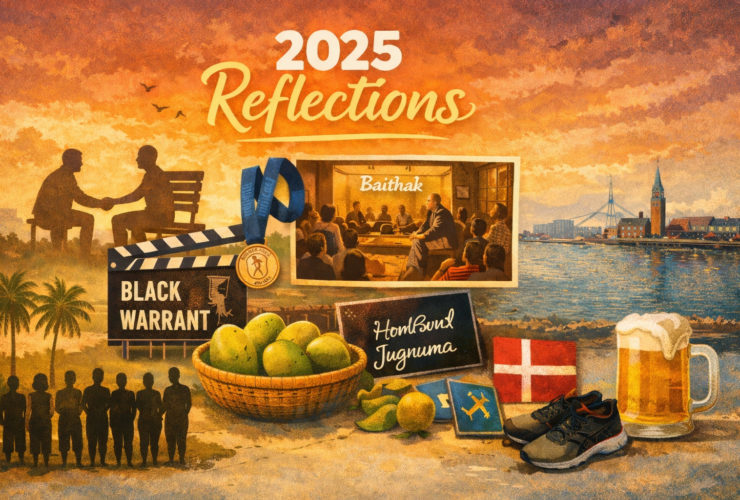

I struggle writing blogs throughout the year, but the end of year post is something I look forward to with some excitement. I don’t know, if it’s the holiday spirit in the air or me getting older (and hence appreciating ‘closures’ more ). You can read our last year’s post here

Personal Updates

2024 was a decent year on personal and professional fronts. I began the year, with a humble resolution of running 2 kms every day and thankfully managed to do it. Given my ‘struggle’ with running, I ended up having a decent year.

I ran two half marathons – in Hyderabad and Udaipur, as well as did run my longest distance during practice – 30 kms. For 2025, I have finally decided to take the plunge and run a full marathon. I have been running half marathons for a decade now and feel it’s finally the time :-).

Organizational Updates

At BuckSpeak, I am super proud of our team. After welcoming Vivek and Sarvani in 2023 (in Client Success and Research & Analysis respectively), in 2024, our team headcount remained at 6. We clearly see a fundamental shift towards non-guaranteed financial assets (equity, debt, real estate and alternate assets). We obviously have been beneficiaries and in our own tiny way, drivers of this growth. However, it’s important to calibrate this journey well, both from the portfolio and organisations point of view. In that context, building the right team is surely, amongst the top 3 exciting things in my life currently.

As a team, we are divided into three broad work areas:

- Client Relations: Subir & Srivatsa

- Client Success: Pruthvi & Vivek

- Research & Analysis: Sneha & Sarvani

Pruthvi joined us in 2015, and I am excited to share that he is gradually transitioning to Client Relations. He brings a decade of experience at BuckSpeak and has seen market cycles and understands investor behavior deeply.

Sneha would also be additionally taking care of Internal Process & Tools, to help us optimize and deliver consistent outcomes for all our portfolios. She has been a part of BuckSpeak since 2017.

This would obviously mean that we are going to increase our team size in 2025. On a side note, a correction in equity markets would be welcome, not just for deploying more funds into equity, but for us to increase our headcount as well 🙂 (reasonable valuations help in all fields).

Skin in the game / We practice what we preach

While in our conversations, we usually disclose our own portfolio, we want to now make it public in our year end posts. When it comes to investment, there is no bigger evidence of conviction than our own portfolio.

Apart from the SIPs we do in our personal portfolios, even for BuckSpeak’s savings and investment, we use mutual funds. We currently are doing a cumulative SIP of 4.55 lakhs (mix of debt and equity funds, screenshot below ) from BuckSpeak’s account.

We have divided our portfolio into three simple buckets:

- Contingency Reserve: short term debt funds (highly liquid)

- Medium Term: for any semi capex expense: long term debt and balanced funds (needs a 6-12 months of planned redemption)

- Long Term: almost ‘perpetual’ in nature, only equity funds

We are also taking an audacious target of scaling this up to 10 lakhs by Dec 2026, if not sooner. We can’t build an investment management house, without being planning it well for ourselves :-). We envisage growth and want to scale through internal accruals.

Last year, I loved sharing my year end sports highlights and movie selections. Let me take the liberty to do the same for 2024.

Movies/ Series

Another year, where I enjoyed an eclectic mix. I particularly enjoyed these :

- Manjummel Boys (a Malayalam movie ) : story of group of friends whose short adventure trip takes a scary turn – Hotstar

- The Day of the Jackal : a lovely thriller story of a sniper, led by the Oscar winner Eddie Redmayne –Jio Cinema

- Shogun (a Japanese series ) : I was just blown away by this Japanese saga, which has already won Golden Globes and other awards this season – Prime Video

Sports

Sports and a country’s rise as an economy are interlinked. For me, two sporting achievements (by Indians) in 2024 stand out.

Neeraj Chopra’s silver at Paris Olympics

For me, this Olympics cemented Neeraj Chopra’s position as the greatest modern Indian athlete. Do read this wonderful Sharda Ugra (one of the best sports writer we have) article . Here’s an excerpt from the article:

Where in this moving, supple Indian sporting universe do we place Neeraj and the silver? Suffice to say, Indian performances in individual sport will from now be measured on the Chopra scale. His parameters are excellence, consistency and success – on the highest platform.

Gukesh Dommaraju

Becoming the youngest ever world chess champion has to be amongst the biggest sporting achievements of the year. Dommaraju Gukesh did just that. I came across this wonderful piece by Aaditya Narayan for ESPN, interestingly titled as 55.Rf2

9:02pm: I see Gukesh waiting for Ding to shake his hand. Enough of the damned poker face. Behave like an 18-year-old normally would now, please? Do tears count? Do 18-year-olds cry anymore? He cried his eyes out, first to dad Rajinikanth, then to Gajewski, then to mental coach Paddy Upton. But then, he held all those tears back, made the most gracious winner at the press conference, and then let us all in on a secret. He’d be bungee jumping soon to celebrate his win.

Until next year, Happy Investing. If you loved reading this post, do share it with someone you love and care for.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned