Show some Real (Estate) love to your portfolio

“Investment, like love, thrives on care, patience, and trust. The more you nurture it, the greater the return.”

Don’t ask me whose said the above 😊, but it does make sense. I also know, that you have almost figured this one, given that the headline is a giveaway. But humour me (as always) for a bit.

I have spent the last 18 years in a city that loves its real estate, trying to ‘convince’ people to invest in financial assets ( both equity and debt). However, all these years, I was doing it wrong. Trying to pitch equity against real estate. The better way is to bring the same love that you have for real estate to your humble mutual fund portfolio.

Disclaimer : this investing behaviour might not necessarily apply to BuckSpeak clients, but it’s true for many of us.

Let me now elaborate :

- You need 50 lakhs for your new car ?

- A close relative/friend needs 30 lakhs ?

- You need to buy your 3rd apartment or do your interiors ?

Just like all roads lead to Rome, similarly, all the above needs are fulfilled by redeeming mutual fund portfolios 😊. I honestly don’t mind planned redemptions. Also, all unplanned ones should be through the contingency corpus, but that’s invariably not the case. We all would agree that the mutual fund portfolio is the first port of liquidity.

We often underestimate the opportunity loss, when we redeem our funds. For example, when we redeem 30 lakhs from our portfolio, we aren’t just redeeming 30 lakhs, but the growth of that 30 lakhs in 7-8 years’ time. Over the years, we have had a few of those redemptions and it’s amazing to know what the portfolio would have grown to, if not redeemed.

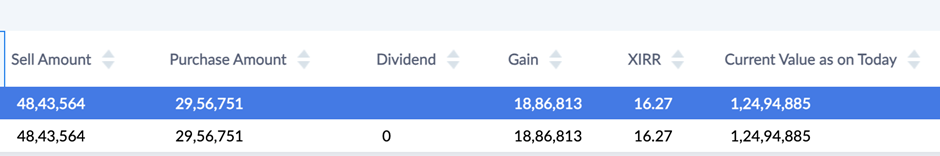

These are real case studies from our portfolios over the years

Case 1 ( 6-7 years) : 48 lakhs redeemed between Jan 2017 to Dec 2018 would have grown to 1.24 cr as on 8th Dec 2024

Case 2 ( 11 years) : Similarly, 60 lakhs redeemed in Sept 2013, would have grown to 3.6 cr

I am not against redemptions. For all practical purposes, investment is to be enjoyed (responsibly 😊). In fact BuckSpeak’s tagline is: Building wealth for every passion. Hence, there is no doubt that we want to build wealth that helps you live passionately. But it wouldn’t hurt if some of us, show the same love to our funds, that we have for real estate. It would serve us well, to keep in mind, the value of the investment that we are redeeming.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned