The KHANs and The FAANGs : What an era it was!

An era can be said to end when its basic illusions are exhausted. – Author: Arthur Miller

FAANG stands for the contemporary tech giants ; Facebook (now Meta), Apple, Amazon, Netflix and Google (now Alphabet).

KHANs we all know, represent the triumvirate of Hindi movies for the last 30 years; Shahrukh, Salman and Aamir Khan.

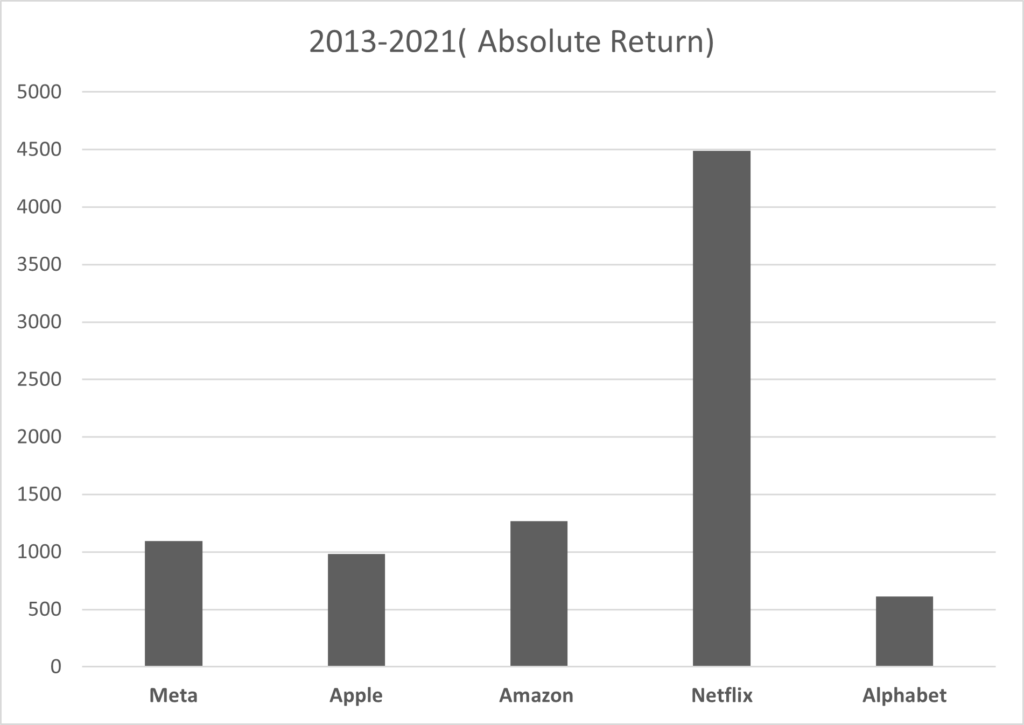

While FAANGs had a more than 10 year dream run till 2021 (in the stock market) , at the same time, the three Khans were delivering one hit after another in the last 30 years (with few lean patches in between)

While Netflix stocks did have a crazy run, but the other 4 also created outsized wealth for their patient investors, growing 7 to 12 times in this period (9 years). If you go back further, the results are even better.

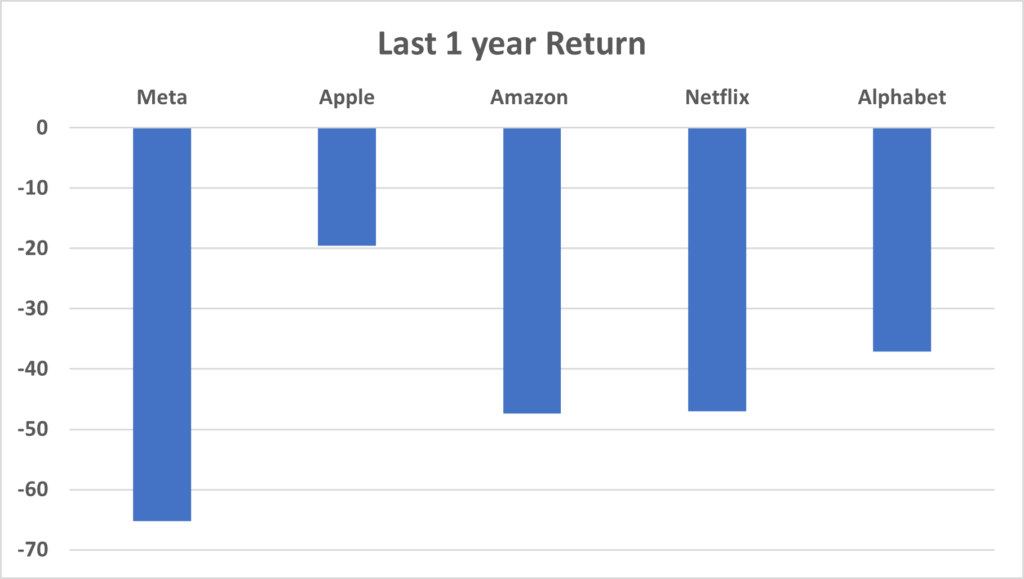

However, the journey has reversed in the last 12 months :

It’s a good time to reiterate a simple but important fact about these performances : a 100 to 200 is a 100 % growth, but a 200 to 100 is a 50 % downside. Apologies for stating the obvious. The negatives hurt you more, in numbers as well as life.

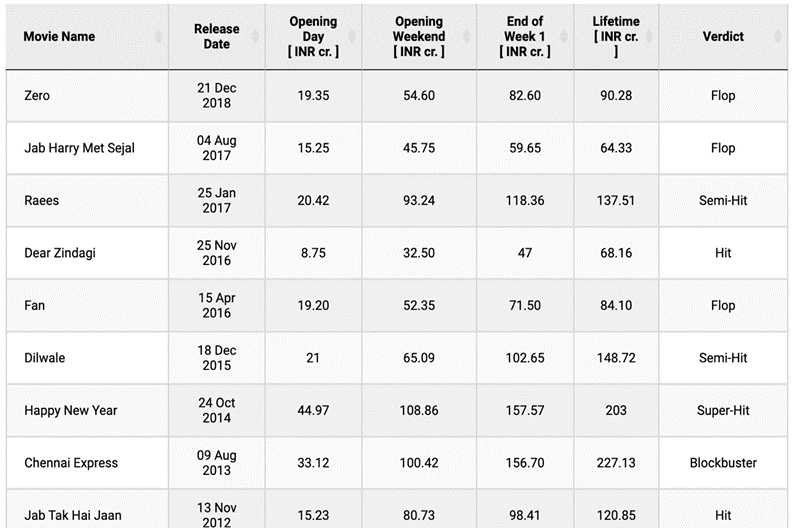

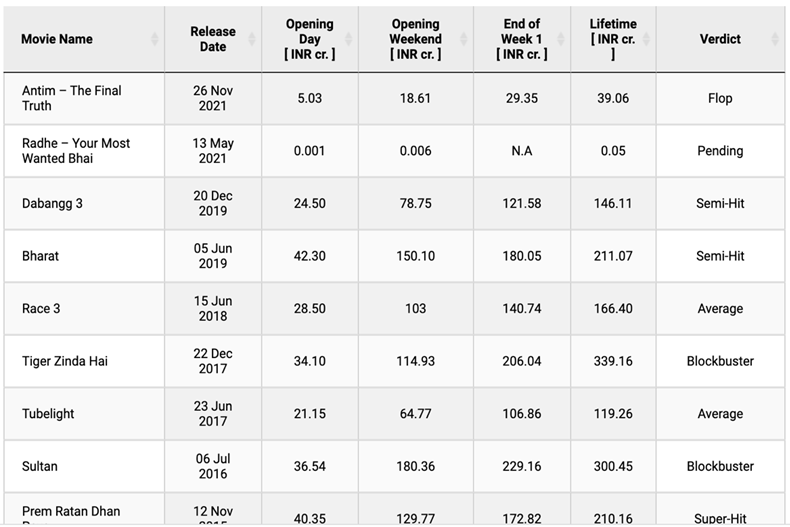

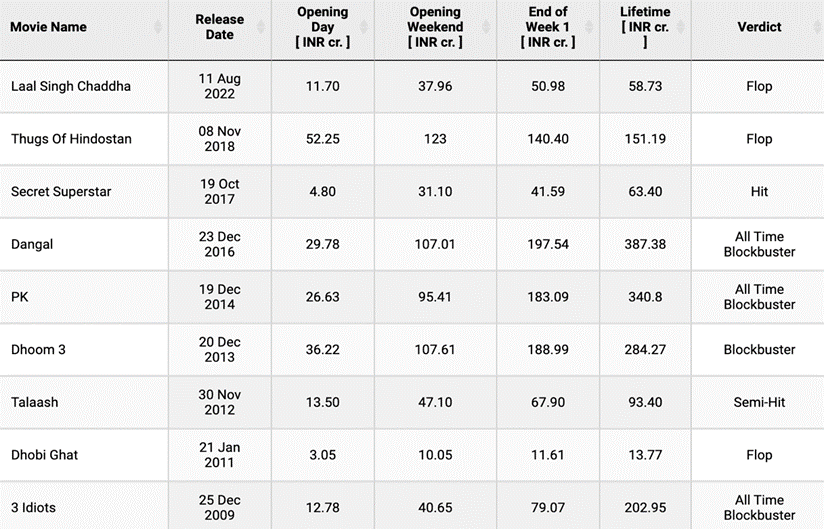

I know a movie shouldn’t be measured only in terms of its commercial success alone. However, given that this is an investment blog, we have to live with this limitation 😊. Let’s look at the commercial performance of the Khans in recent times

Shahrukh Khan

Salman Khan

Aamir Khan :

Shahrukh had his last major hit in 2015, Salman in 2017 and Aamir in 2016 (Secret Superstar wasn’t really spearheaded by him).

I am neither an expert on stocks (personal finance, risk profiling, curating portfolios with managed funds are our strengths) nor a movie critic, but the numbers do tell a story.

For FAANGs one major challenge is the base effect. They have become so large, that for them to continue delivering such returns is extremely difficult. In Investing world, no company is sacrosanct and their a right price for even the best of them. Cisco and Intel were in similar position in 90s and have never been even able to cross their 2000 highs. Having said that, we are sure FAANGs ( at least some of them) would continue to stay significantly relevant. The same goes for the triumvirate, who I am sure would reinvent themselves and would continue to entertain us.

It’s commendable for both the groups to have stayed at the top for so long, especially the Indian one 😊

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned