Investing, Kumbhkaran and Daily soaps

This Diwali, don’t just focus on Ram, be a bit like Kumbhakaran & Why Sensex is bit like daily Soaps

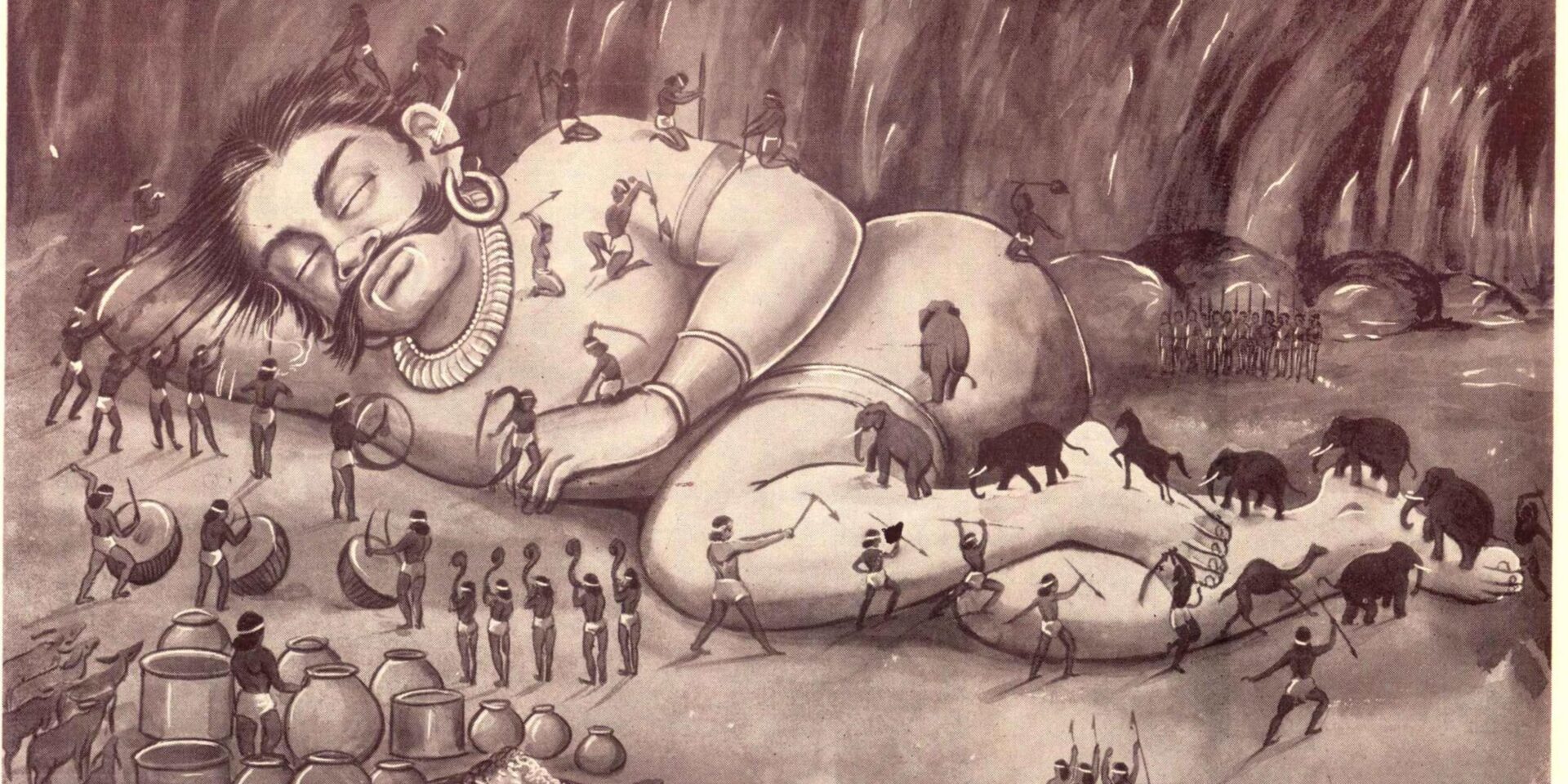

Story of Ravana’s younger sibling

Kumbhakaran was the younger brother of Ravan, who wanted to ask Brahma for Indrasan (position of the ruler of Gods). Instead he ended up asking for Nidrasan (Goddess Sarasvati sat on his tongue). Now how on earth is this related to investing behavior or portfolio returns?

Screen addiction & investing

Each day, on an average, we pick up our phone 58 times and check it 262 times (based on several research studies). Clearly, we love to keep a ‘tab’. In this day and age of instant gratification, it’s only natural that we extend this to our investment behavior as well. However, there is enough evidence that serious and sustainable wealth cannot be created in this manner (any exception is just that…. exceptions).

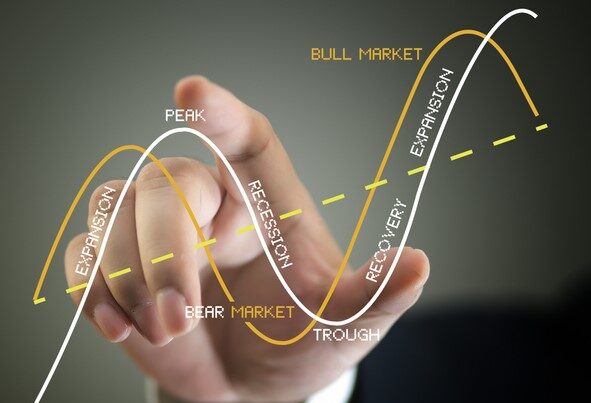

Daily Soaps & Sensex

Let me share another metaphor. My parents visit us every winter and stay with us for 2-3 months. During this stay, my mother used to watch some daily soaps (tele series). In passing, I used to sit along and watch few episodes myself (go on, judge me). Each episode was filled with lot of drama, emotion and twists. As a viewer, you felt that a lot was happening every day. Once they went back, I hardly ever watched them. Next year, when they visited us again, I was back to the ritual. To my wonder, the plot hadn’t moved much.

For me, equity markets and our portfolio, can be a bit like that. If you view it every day or week, you might see quite a bit of movement. Interestingly though, in a year, it perhaps wouldn’t have moved a lot. The downside of watching one’s portfolio frequently, is it can trigger you to take some action. However,90 % of the times, (maybe even higher) not doing anything is the best advice for one’s portfolio.

Obviously, inaction in today’s day and age, cannot be packaged as a ‘smart’ thing to do. This alone, would remain the single biggest impediment towards wealth creation for the current generation

Back to Kumbhakaran

Inaction brings me back to Kumbhakaran, one of my favourite characters from Ramayana. His ‘boon’ meant, he slept for 6 months at a stretch, woke up and went back to sleep. I like that frequency of checking portfolios; once every 6 months. What’s my frequency for checking personal portfolio? I am lazier than Kumbhakaran, is all I can say 🙂

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned