Hungry? Don’t Zomato just yet

Disclaimer: This is not an attempt to diss Zomato as a company. I have lot of respect for what they have achieved. Personally, was a frequent user of the app, when it was only doing restaurant ratings. In fact, felt so proud to use it outside India as well. We are also not trying to dissect their business model. I leave that to our Fund Managers.

Coming back to Zomato’s IPO, most of you know that I am not a huge fan of IPOs in general. Let’s first understand, the reason why company’s come to public markets (stock exchanges)? Mostly for the capital they need to grow, sometimes to retire debt or to provide an exit to their existing investors. Investors like companies which need it for the first reason. However, these days companies are coming to public markets for growth capital, at a fairly later stage. So, where are they raising capital from? Short answer : Private Markets are writing generous cheques for them. They have obviously grown in size and have now become much bigger than public markets. Some large VC firms are : Tiger Global , Sequoia , Accel. In the P-E space , we have Blackstone ,KKR, Carlyle Group, TPG , amongst several others. As per a Credit Suisse Report, in the last 3 years Indian firms have on an average raised $ 34.5 bn through private markets compared to $15.1 bn, raised on an average from Public markets

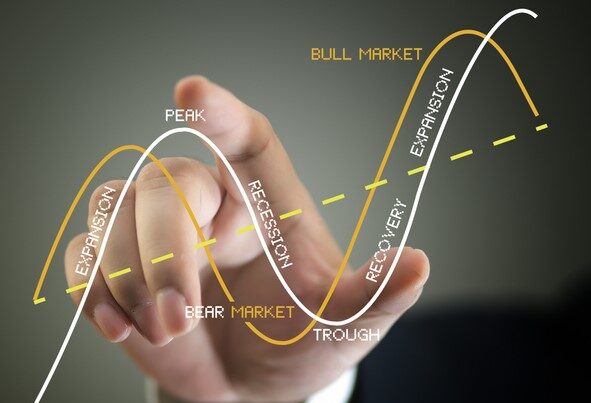

Having addressed the why, let’s explore the when part of an IPO. Obviously, IPOs are done, when the promoter feels that they would get the best possible price for their company. Hence IPOs love bull markets. Look at the table below to understand this better:

| Year | Amount Raised (in Rs cr) |

| 2021 (YTD) | 29,936 |

| 2020 | 26,628 |

| 2019 | 12,687 |

| 2018 | 31,731 |

| 2017 | 75,279 |

With the slew of IPOs lined up for this year, it would definitely be closer to 2017 (an IPO for LIC is also on the cards). So investors flock to the stock market when the preceding 12 months or so, have been great. You get the drift on, why the ‘when’ of these IPOs is a problem.

Let’s dwell a bit more on the valuations of these IPOs. Everything is going great guns for a company like Zomato:

- Due to Pandemic, people are ordering much more than ever before

- As per www.livemint.com ,India opened a record 14.2 Mn new Demat accounts in 2020-21. I bet many of them were also ordering on Zomato. What’s staggering about this number? Its nearly 3 times the figures of the previous fiscal year

- Indian and global equities have recovered strongly from their Mar 2020 lows. Nifty, the Indian index of top 50 companies, has gone up 82.5% ( as on 30th June 2021) , since its 31st Mar 2020 lows

The probability of these metrics going down/plateauing is much more than they going up, which isn’t great for the stock. It’s much more easier to speed up from 60 kmph to 100 kmph , but incrementally tougher to take it from 100 kmph to 140 kmph ( I am sure , some of the racing enthusiasts would disagree :-))

What does it mean for you as an Investor?

Does it mean that investing in exotic private market products (AIFs / VC / Startup funds), is the only way to earn meaningful (I don’t like the word high :-)) returns? The answer is an emphatic no. One of the biggest strengths of public markets, is their price efficiency in the long run. Once the euphoria settles, companies start getting the fair price for their shares. So, it is here that , an equity investor’s biggest weapon, PATIENCE, comes in handy. So, there is no rush to join the bandwagon. Remember mistakes are mostly made in good times, not so much in bad times.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned.