Death and Investing!

Memento Mori

Stoicism talks about the concept of Memento Mori, which means ‘remember that you are mortal’. Before you label me as a depressed guy, hear me out (or rather read ahead 😊). Stoics believe that by remembering about death every day, instead of being depressed, it adds more fuel to one’s life.

In ancient times, people encountered risk to their lives, far more often than today (except for few professions). In modern times, we are more secure and our brush with death is far more infrequent.

What has this got to do with Investing?

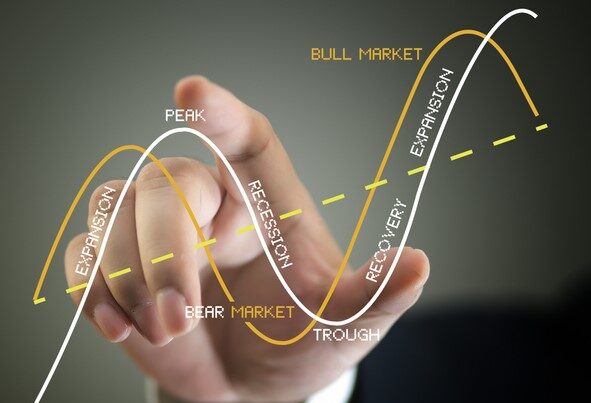

Investing (especially into equities, though not necessarily) is a non-linear experience. As humans have progressed, we have removed unpredictability from several walks of our life. It makes sense as well, since it improves efficiency, the hallmark of progress. Google maps, Netflix recommendations, Outlook calendars are all tools in this pursuit.

However, investing still demands acceptance to unpredictability. Forget equity, in CY 2022, most bond funds in US delivered returns even lower than -10 %. So, without doubt volatility is intrinsic to investing. Therefore, it only makes sense to befriend it. In fact, the best of investors, seek volatility and love it.

Easier said than done? Absolutely and hence investors keep measuring a fund manager’s performance over months and quarters, which is ridiculous to put it mildly.

Ok, enough of gyan, ‘karna kya hai ?’

Like most things in life, not every problem has a solution 😊. But being aware is the first step and an important one at that. So, just like one should keep reminding oneself every day, about ‘Memento Mori’, maybe once a month, remind yourself of ‘Levitas est amicus meus’ (Volatility is my friend). Don’t judge my Latin now.

Also don’t forget this song from the very famous country musician Tim Mcgraw Live Like You Were Dying (it has nothing to do with investing, I just loved the lyrics)

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned