Dangers of Data and Trust being Tangible

( This article was first published on 1st June 2023)

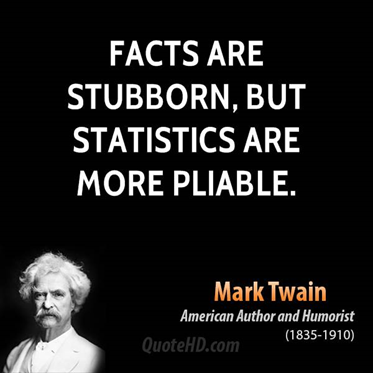

In our world, everybody is an expert. It’s easy to be an ‘expert’ in investing. Why ? There is abundance of data :-). However there is a thin line between an informed investor and an ‘expert’ investor. By expert here, I only mean people whose full time job isn’t managing or advising people on investments 🙂 .

Cost of being an ‘expert’

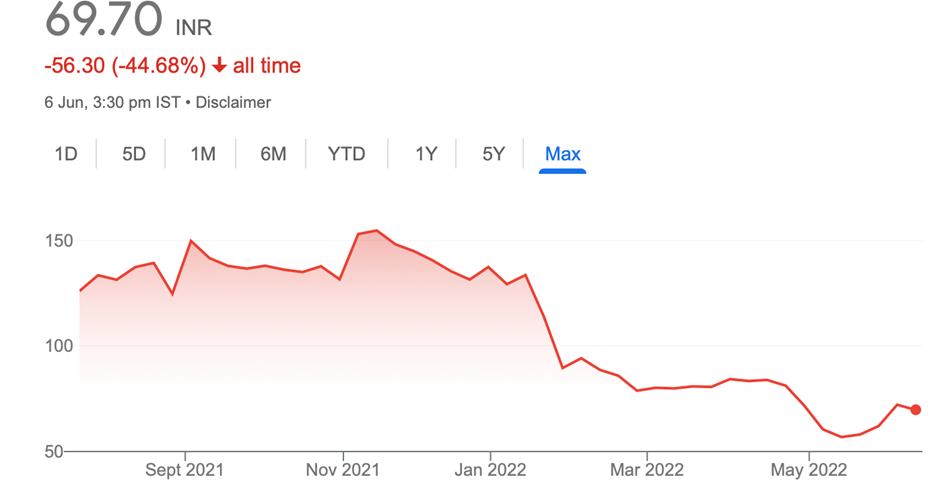

However, this ‘expertise’ can often come at some cost and that’s why it’s dangerous. Case in point, the current times. There is a whole generation of investors who had only witnessed upside in their short investing life, until they saw something like this 🙂 ( share price movement of a new age ‘start up’ )

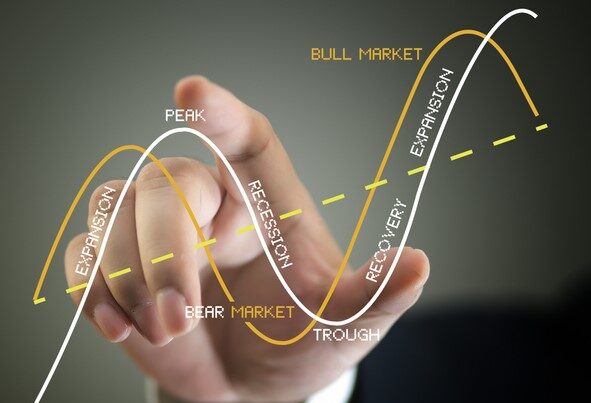

Yes, we live in uncertain times and yet to term it as ‘extraordinary’ or ‘out of normal’ would be naïve. The global economy and consequently investing has always been a function of ‘uncertain’ events and yet with time, it doesn’t feel too terrible.

Too much of a good thing

Having said that, this post is not about dissecting data and trying to arrive at some ‘forecast’ based on that. It’s about the unique problem this overload of data can cause. In this day and age, we all are spoilt for choices, especially when it comes to high quality data. The problem is, often we consume excessive amounts of it. All of this, while negotiating an extremely hectic and draining job of our own ( which by the way pays the bills).

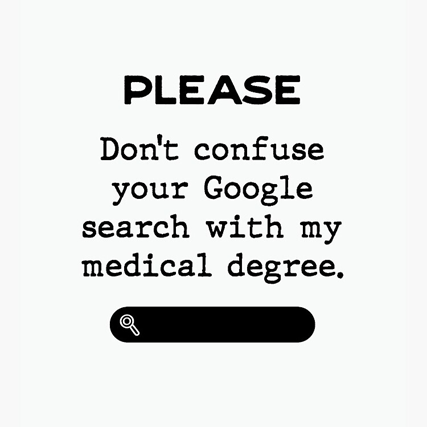

Imagine arriving at an investing decision once you have read some neat deck on impact on global economy, in the aftermath of Russia- Ukraine war. Wouldn’t it be similar to a non-medico looking at their Lipid profile reports and arriving at some self-diagnosis ? We all know how dangerous the latter is.

What’s the alternative ?

I am not building a case for the other extreme, which is to have blind trust in ‘experts/advisors’ :-). (Disclaimer : we have some conflict of interest here ). Figuring out the best approach, in an investor-advisor relationship, is what we at BuckSpeak spend a lot of time on. This has a significant role to play in portfolio outcomes. You don’t need to be from finance domain to extract better portfolio returns. On the contrary, it can be a drag. So, what’s the solution ?

In our experience, one of the biggest contributors to this, is ‘Trust in competency’. While ‘trust in Integrity’ is hygiene (at least should be), the former is often neglected and not fully comprehended. Trust in competency ensures :

- Not falling prey to ‘hot’ investing ideas

- Getting into opportunities when they don’t look that obvious

- Corollary to the above, not falling into ‘recent’ winners trap

And how does one build this trust ?

- Due diligence before you sign up

- Asking lots of common sense questions ( especially in the beginning of your relationship)

- Mutually agreeable process of decision making between the investor and their advisor

- Staying honest to each other

Nothing fancy, but ‘trust’ us, it works.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned