2022 : The ‘Dull’ Year in Investing

I know we are well and truly into the new year, but I still think that it’s not too late to share our piece for 2022. Let me take this opportunity in wishing you, your family, your loved ones and all of us a very Happy New Year.

Let me begin with something we have reiterated several times in the past. This is the tweet from Marc Andreessen, cofounder, and general partner at the venture capital firm Andreessen Horowitz

The word for 2022

In our 2021 end blog (https://buckspeak.com/blog/liquidity-2021s-most-used-word-in-the-financial-world/) we had mentioned ‘liquidity’ as the most used word for 2021. It’s only fitting that ‘inflation’ follows it for 2022. Inflation plagued the globe and India as well, though in India we were relatively better off

Hopefully things are getting better on this front, with inflation showing signs of moderation

Asset Classes : Equity

In the year end post last year, we had hoped for the next 2-3 years to be ‘dull’ for equities. 2022 was indeed dull for Indian equities. Couple of strategies allowed us to protect some downside:

- Not investing any lumpsums into global markets in 2021 (we have been accumulating them gradually in 2022)

- Scaling down our equity exposure in 2021

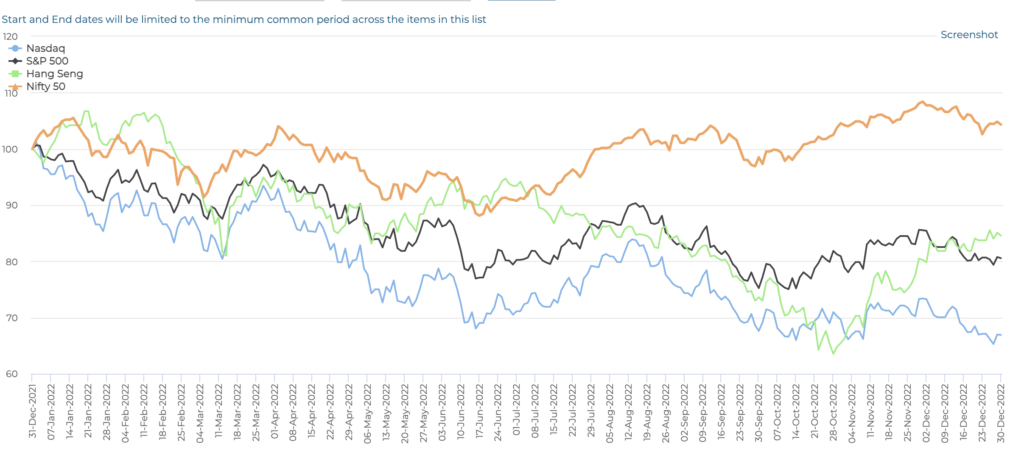

However, even by delivering ‘dull’ returns, Indian equity significantly outperformed its global peers:

Our take for the near term is that India should now participate with the rest of the world, after such significant outperformance. We don’t know the direction of this move, but we are clear of India’s participation. Indian equities long term robust and advantage of other investment options remains stronger than ever before

Asset Classes: Debt

This was a rough year for debt funds. With more than 200 bps (2 %) hike in interest rates, debt funds had a huge mountain to climb. They didn’t too bad though. Most of the debt funds delivered around 3.5-4 % p.a. Which in absolute might not look great, but if you are in it for 3 years (that’s where the long-term capital gains kicks in), you still did better than FDs (post tax). This is assuming you are paying more than 30 % tax on your incremental income.

Going forward, the returns look much better. We don’t know about the next 4-6 months, but over the next 18 months or more, we should significantly see better return

Asset Classes: Gold

Gold was the underdog that no one was rooting for. And boy, did it surprise everybody.

It delivered significantly better return with much lower volatility. That’s why we recommend a 5-10 % allocation into it. Its performance might frustrate you on occasions, but it’s the best option for hedging your portfolio

In-house Updates:

Year end is also a time to take stock of our journey. All of you are partners, stakeholders and believers in BuckSpeak’s journey. It only makes sense to apprise all of you on a few updates.

The Choices we Make or don’t

As you would know we aren’t enamoured by PMS/ AIFs just because they appear exotic or have higher threshold. Both, along with mutual funds fall under one category, called ‘Managed Funds’. So, if any of these products meet our criteria on 1) Team 2) Process 3) Consistency, married with their alignment with specific customer portfolios, we don’t mind recommending them

In 2022, we added Unifi PMS as part of our recommendation. It’s a great team, with 20-year track record in money management. They currently manage around Rs 14,800 cr (as on Dec 2022). The theme we are recommending does fall under high-risk high conviction play

Team Updates :

We are currently a 5 member team, divided under 3 groups: Client Relations/ Client Success and Analysis & Research. We are eager to add the right team players in all the three divisions. Our expansion is more of a function of finding the right individuals, instead of filling up a job profile. In simple terms, we want people who are ready to play the long term game.

Our idea of delivering high touch, bespoke investment solutions is what we think, would keep differentiating us from others. We also are clear that we aren’t the only ones doing this well. I am sure there are others 😊. The Indian eco-system needs quite a few BuckSpeaks (pardon the narcissism)

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned