Can you bear the pain to see the gain?

I started my career at Kotak Mahindra Bank in June 2006 in their wealth management business. I was a management trainee for the first 6 months and started handling clients only in 2007.

Those were heady days for equity and to be honest, nobody spoke of long term, considering people got double digit returns in a month or a quarter. Investing in NFOs, exotic themes (funds with fancy names), moving from one fund to another (every year, since long term tax was nil) was quite common. Nobody spoke of debt funds, 7-8 % in a year looked pedestrian, compared to equity returns. Investors borrowing against shares / mutual funds to buy more of them wasn’t as rare as one might think. And then Lehman and the Global Financial crisis (GFC)hit us. Indian funds corrected by 50-75 % between Jan 2008-Mar 2009. In direct equities, it was much worse.

However, this post isn’t about scaring you or drawing parallels. It’s about resilience and how over long term, equity investments can survive any degree of volatility. This post is about an investment I had recommended while I was still at Kotak and convinced my client to stay invested for over 14 years. It was done in June 2007; it fell like nobody’s business during GFC and survived

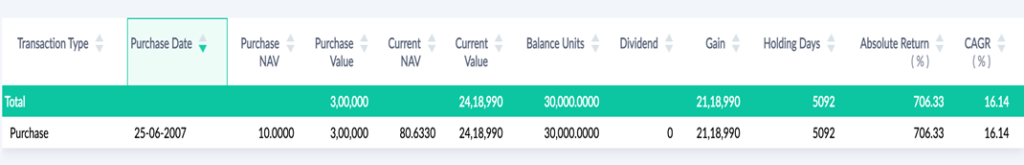

Rs 3 lakh has grown to little more than Rs 24 lakhs in 14 years. I have not shared the fund name, since that’s not as important as one might think it is. Yes, it’s a mid-cap fund, so it comes with higher risk. Some facts about the journey of this investment:

- After growing to Rs 3.9 lakh (31st Dec 2007), it fell down to Rs 1.76 lakhs by 31st Mar 2009 (initial years, its far more vulnerable)

- On 31st Mar 2020, it had gone down to Rs 11.7 lakhs, which wasn’t too terrible either (with age it gains strength)

- Its 4 biggest falls since inception, were -60 %, -40 %, -25 % and -19 % (volatility is par)

- On 30th Aug 2013 (6 years after its inception) , the fund’s CAGR was a poor 7.6 % p.a.

Disclaimer : Past performance may or may not be repeated. However, with right guidance, patience, acceptance of volatility and over long term, one can definitely create meaningful wealth. Equity investments can correct 50-60 % or even more and hence, one needs to have the right asset allocation in place. Nurture your investments while they are young, don’t monitor them frequently, especially during volatile periods. I promise you, they age well.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned.