Union Budget 2024-25 : The Past, Present and Future

While personal income tax occupies the maximum attention, a country’s budget encompasses much more. Ultimately, a Union budget is quite similar to a household’s. It’s a detailed statement of income and expenses. We share 4 key numbers from this budget and how India fares on each one of them

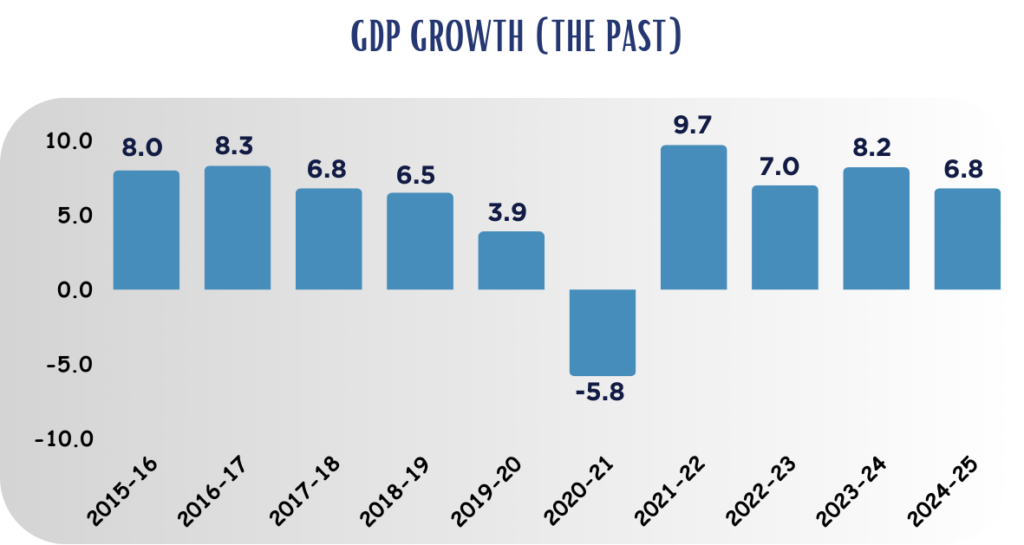

India is now the fastest growing major economy in the world. With China’s GDP hovering around 5 % and expected to slow down further, India is in the lead for now. Having said that, we need to grow faster than 7.5-8 % p.a., consistently for a longer period. Needless to say, we cannot be complacent.

Fiscal deficit for a country, is the shortfall in a government’s income compared with its spending. In the post covid world, Indian economy’s greatest strength has been its control on fiscal deficit. As you can see, India has been able to reign that in, from a post covid high of 9.2 % to 4.9 %. Growth in the revenue from taxes (income tax, GST, et al) has helped the cause. This is also the reason why India has managed the inflation and interest rate changes, much better than most developed economies, including USA.

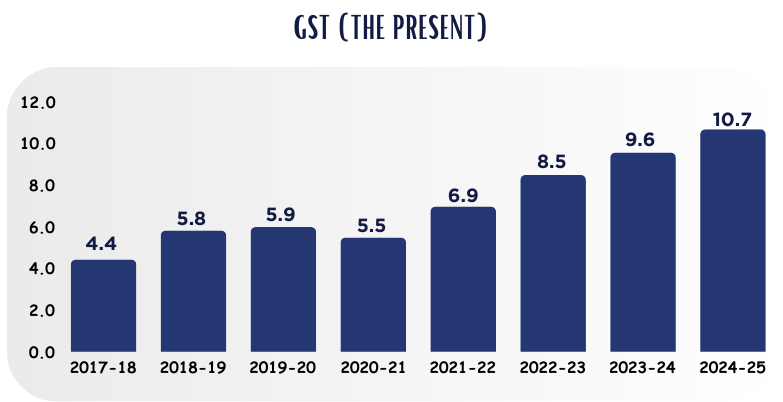

The M-o-M (Month on month) growth in GST has been one of India’s greatest success stories in recent times. At some stage, the growth rate would plateau, but for now, it is really helping the govt budget. In April 2024 itself, GST collections breached 2 lakh crores.

..

For a fast-growing economy, the money spent on capital formation is worth its weight in gold. Roads, ports, airports, power projects, etc., fall under this head. India has done an excellent job in allocating higher amount of funds for this. From a 2.5 % increase in allocation to the current 11.5 %, the sector has been doing the right ‘spending’.

While the tweaks in personal income tax does not help, the fundamentals of the Indian economy are in good shape.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned