Year end 2023

“I probably trust the answers that come out of ChatGPT the least of anybody on Earth.” — Sam Altman, CEO of ChatGPT-maker OpenAI, remarks at a forum in India, June 8, 2023. I was looking for quotes from 2023, that could perhaps encapsulate the year. I don’t know if this one does the job, but I just found it interesting, when we are at some sort of crossroads between the human intelligence and AI.

Phew; what a year 2023 was!! While I know my job as an Investment Management (I honestly struggle with my job title in the wake of regulatory guardrails) professional, demands that I stick to my domain, but humor me a bit. It is after all a year end note 😊.

But let’s start with the economy and markets

The equity markets went up. I know, I should have used much better adjectives, but for me, markets going up isn’t necessarily something to be celebrated and vice-versa. If you follow us and our commentary, you know, we believe small and mid-caps are frothy. Forget the main exchanges, the SME exchange, which is a platform for SMEs to raise capital (Rs 10-20 cr for each company), has gone bonkers. The total market cap of companies listed on SME exchange (both NSE and BSE have one each) is a mind whopping Rs 2 lakh cr

But, as an investor, you ought to love extremes, that’s where wealth is created. Enter, ‘profit-booking’. We have spoken a great deal about it in our earlier communications and will avoid deep diving into it here. To sum it up, we are reducing our exposure in mid and small cap

Indian Economy; the Long-term Story

There is absolutely no doubt on the long-term robustness of the Indian economy. If I can use a cricketing metaphor, it’s our match to lose from here. I have a feeling, we won’t.

However, the best proxy for the India growth story is the iPhone journey in India. For the last few years, iPhone sales has been growing close to 50 % Y-o-Y. As per estimates, Apple would sell 10 mn iPhone in 2023, making India ( a low income country) the 4th/5th largest market for Iphones.

Belief can move mountains

In the last 5 years, India’s biggest Believer has emerged. She is the humble middle-class SIP (Systematic Investment Plan) investor. The channelization of household savings into capital markets couldn’t find a better champion. From Jan to Nov 2023, (the data for Dec 2023 is still not published), around Rs 3.32 lakh crore got invested into capital markets through SIPs alone. The full year number should be close to 3.5 lakh crore. This for me, represents the confidence of Indians in India, a trait, which was absent for the longest time

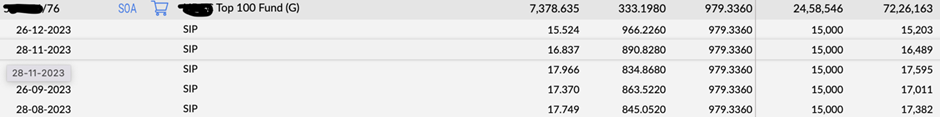

Simplicity has triumphed

Above is an investment screenshot of one of our investors; the fund is not really that important (it’s a large cap fund). A humble 15 k SIP from mid 2010 to till date (Dec 2023) has grown to 72.2 lakhs (as on 31st Dec 2023). Post tax, net of all expenses managed funds haven’t done a terrible job. Is it easy to replicate this? Absolutely no, the global economy has seen lot of ups and downs during this period and staying course wasn’t easy at all.

In the world of AIFs, PE funds, unlisted shares, the humble SIP has stood its ground. Bottom line: There is a case for allocating lion’s share to simplicity in our portfolios

Art of Tough Convincing: The BuckSpeak Way ( our recommendations)

While the world loves investments which have done well in the recent past, we explore exactly the opposite. We pick up themes that have been beaten down. Needless to say it has worked well for us (hence the mention 😊). Obviously, the markets behaving the way they are, it is not getting any easy to find such reasonably valued themes. End of 2022, we started talking about Healthcare/pharma and Taiwan funds. Both have done significantly better than the broader market in 2023. Disclaimer: We don’t add any positions in such strategies, unless and until the portfolio reaches a certain size and vintage.

Quick take on the road ahead:

We hope (because we don’t know), that equity markets cool off. 2022 was that kind of year and was extremely rewarding for our investors. We would love to have another round of dull 12-18 months (or even longer). If you have been with us for less than 2 years*, such a dull period can bother you. Your CAGR might come down quite a bit, but believe me that would be the best thing for your long-term portfolio

*since we aren’t booking any profit from your equity portfolio

The Team Update:

We love sharing our growth journey with you, since you have ‘invested’ with (to be read as ‘in’) us. For me personally, it’s an exciting journey to build a boutique full stack investment management firm, out of Hyderabad, catering to clients across the world (every 3rd client of ours is from outside Hyd).

Our team grew this year as we welcomed two young minds into our family. Vivek Rathi joined us in Jan 2023 and Sai Sarvani* in October. If we ask you to invest for long term, as a firm, we need to walk the talk and investing in a team is our effort in that direction.

Vivek would join the Client Success Team and work alongside Pruthvi. Sarvani has joined the Research & Analysis team, working alongside Sneha. We fiercely value the bandwidth we offer to our clients and the team growth ensures that we maintain a healthy bandwidth.

*Sarvani discovered us online through our blog and got in touch. We liked her a lot and onboarded her, even though we didn’t have an immediate opening

We are hugely bullish on the financialization of Indian investments and building wealth for our clients’ passionate lives.

Sports :

2023 was also the year India hosted the 50 over cricket world cup. While India didn’t go on to win the finals, the team’s performance leading up to the finals was a delight to watch. Loved reading these two pieces ; one on the team and the other one on Shami, who was an absolute revelation. Neeraj Chopra, continues to be the greatest current Indian sportsperson and he clinched the Gold in the World Championship. Do relive one of the great pieces in Indian sports history

Neeraj Chopra – World championship, Javelin throw

Mohammed Shami: With 23 wickets from 6 matches, he is already the Player of the Tournament

Movies :

Here’s the couple of movies I thoroughly enjoyed this year.

Nanpakal Nerathu Mayakkam | Official Trailer

Three of Us Review : An Ode to Memory and Being Present

Once again wishing each one of you and your families a lot of joy, happiness and good health in 2024. I am filled with optimism for the times to come.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned