“In war, prepare for peace; in peace, prepare for war”

“In war, prepare for peace; in peace, prepare for war.” – Sun Tzu, author, ‘The Art of War’

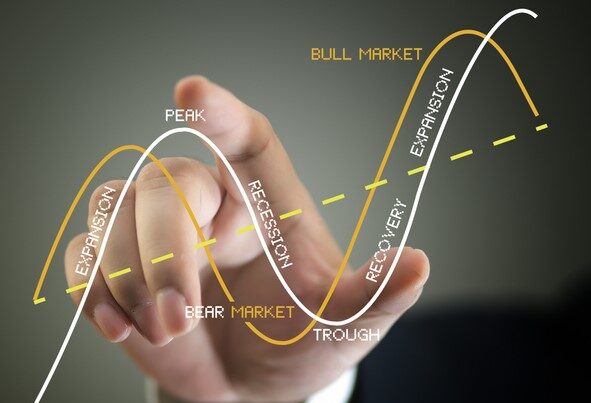

I know that Warren Buffet’s favourite holding period is, forever. However, most of us don’t have that kind of luxury as we have goals to fulfill”. Also, ‘timing’ the market isn’t celebrated enough. On the contrary, almost looked down upon. So, here I am, asking you to do just that; ‘time’ the market. Humour me for a while.

Why should you reduce your allocation into equity in general, and small cap in particular ?

- Valuation logic : The whole investing ecosystem breaks into a chorus to buy, when there is a significant correction in the equity markets (as in Mar 2020, 2013 or 2008-09). These calls are made on the valuation gap that is created by such falls, vis-à-vis the long term fair valuations. However, similar calls are not given to reduce equity allocations, during periods of over-valuation. Current levels are 15-20 % more expensive compared to long term median valuation

- Money chasing returns : The inflow into small caps has increased significantly in the last few months, which clearly demonstrates that investors are chasing higher returns. This is exactly opposite to buying low and selling high (which itself is a utopian concept). Look at this net inflow in mutual funds (in Crs)

| Small Cap | Total Equity | Small Cap inflow as % of overall equity inflow | |

| After not-so-good performance | |||

| Apr-22 | 1,717 | 15,890 | 11% |

| May-22 | 1,769 | 18,529 | 10% |

| After good performance | |||

| Small Cap | Total Equity | ||

| Jun-23 | 5,472 | 8,637 | 63% |

| Jul-23 | 4,171 | 7,626 | 55% |

| Aug-23 | 4,265 | 20,245 | 21% |

- If lower than expected return should worry you, then higher than expected return should as well : If 8 % p.a. CAGR or below, over 5-6 years from equity would bother you, then current returns should as well. Most small cap funds have delivered between 19-25 % p.a. CAGR in the last 5 years ( as on 30th Sept 2023). Else, we are falling into the ‘greed’ trap.

Portfolio actionable ( obviously to be taken in under an expert’s guidance ) :

- It is not the worst time to reduce one’s small cap allocation, especially, if you have been smart enough to build it over the last 4-5 years

- This would also be a good time to do your Diwali cleaning of holdings early. Get out of non-performing funds or smaller holdings that you would have accumulated over the years

- If one has started investing only in the last 12-18 months, you would do well to be prepared for some volatility. There is no point in booking profit for such short term holdings. You would do well to stomach the volatility and welcome it instead.

Equity investing is about having a process and staying true to that process. Today is an equally important time to be reminded of that. Happy Investing and ‘redeeming’.

Disclaimer : No part of this article should be seen as investment recommendation. Please consult your MFD or RIA before taking any portfolio decision. Equity investments are subject to market risks and are volatile.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned