INFLATION & INVESTING : IN CHARTS

This month’s blog post has been a struggle. If you keep a tab on what’s happening in the world of investments (and anything related), I wouldn’t judge to go bonkers.

But then are some events in the financial world, which has a significant everyday impact on all of us. One of which is making life difficult for all of us (in varying degree): INFLATION

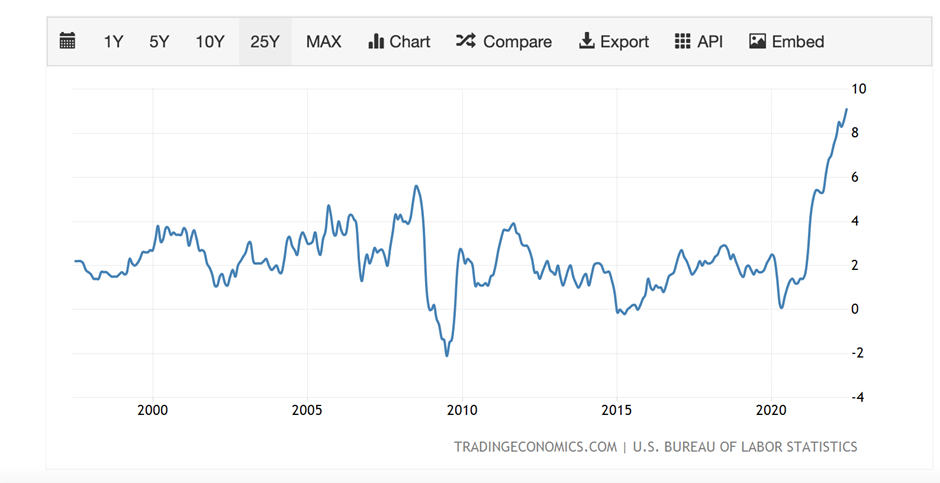

The developed world (especially US) is facing unprecedented amount of inflation

US inflation since 2000

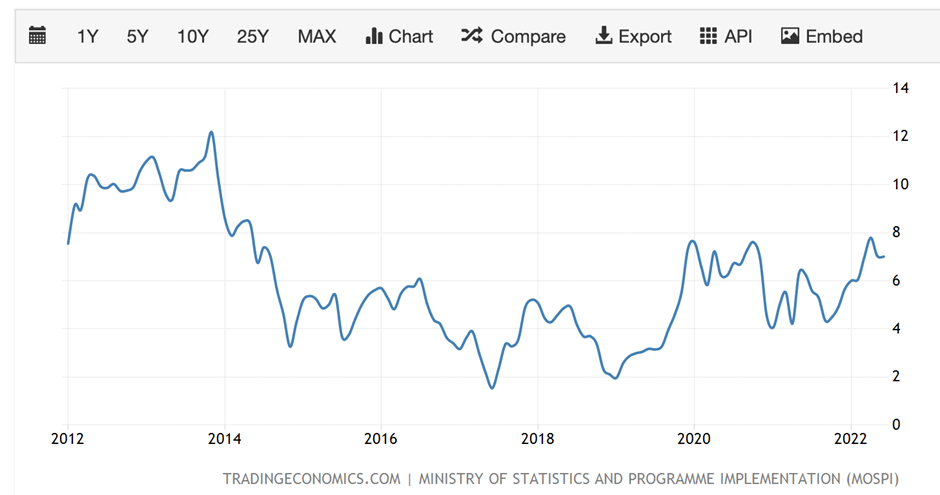

India on the other hand has seen similarly high levels in the past, in fact even in the last 10 years

At current times, no asset seems to be a safe haven. Having said that, the strategy to beat inflation reminds me of this: In times of peace, prepare for war.

In the Indian context, in recent times, investing into equities from 2001-2004, 2010-2013 & 2018-mid 2020 delivered higher than average returns. These were all periods of negative/ low positive returns.

Without a doubt, equity is best suited to build a long-term inflation beating portfolio.

This one chart says it all.

This in no way means that equities would beat inflation over every 2–3-year period. There would be periods wherein we can have high inflation and even negative returns, but over long-term equity does the job.

Rate Hikes and Equity markets:

In the same period, Nifty:

Bottom line: The short term might be choppy, but as seen in the past, every correction is a great opportunity.

Disclaimer: Any calculation shown in this post is only for illustrative purposes and based on prevailing tax laws and the past performance of a fund or investment is not an indicator of it’s future performance. The data used in this presentation has been taken from several sources. Neither BuckSpeak nor any of its employees or Subir Jha vouches for the authenticity of the data. Investing in mutual fund comes with market risk. Please read all Scheme Information Documents (SID) /Key Information Memorandum (KIM) and addendums issued thereto from time to time information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund. Investment should be done in consultant with a financial planner/consultant, who would recommend products aligned to your needs and risk profile. There are no guaranteed returns. Neither BUCKSPEAK NOR ITS EMPLOYEES, makes any warranties or representations, express or implied, on products offered and would be responsible for any losses from these investments. The company earns commission from Asset Management Companies when the user buys mutual funds. However, the recommendations on funds is not influenced by the commission earned